Covering direct and indirect lending, from quoting to funding.

Originations in Alfa Systems represents an integrated part of the Alfa Systems platform, allowing customers to take advantage of Alfa Systems’ total capability.

Alfa has responded to changing market requirements, as well as customer feedback, by expanding the functionality of our Originations product to be the premium solution to occupy a place at the heart of your business, allowing you to operate a single system that incorporates our powerful Originations, Servicing and Collections capabilities.

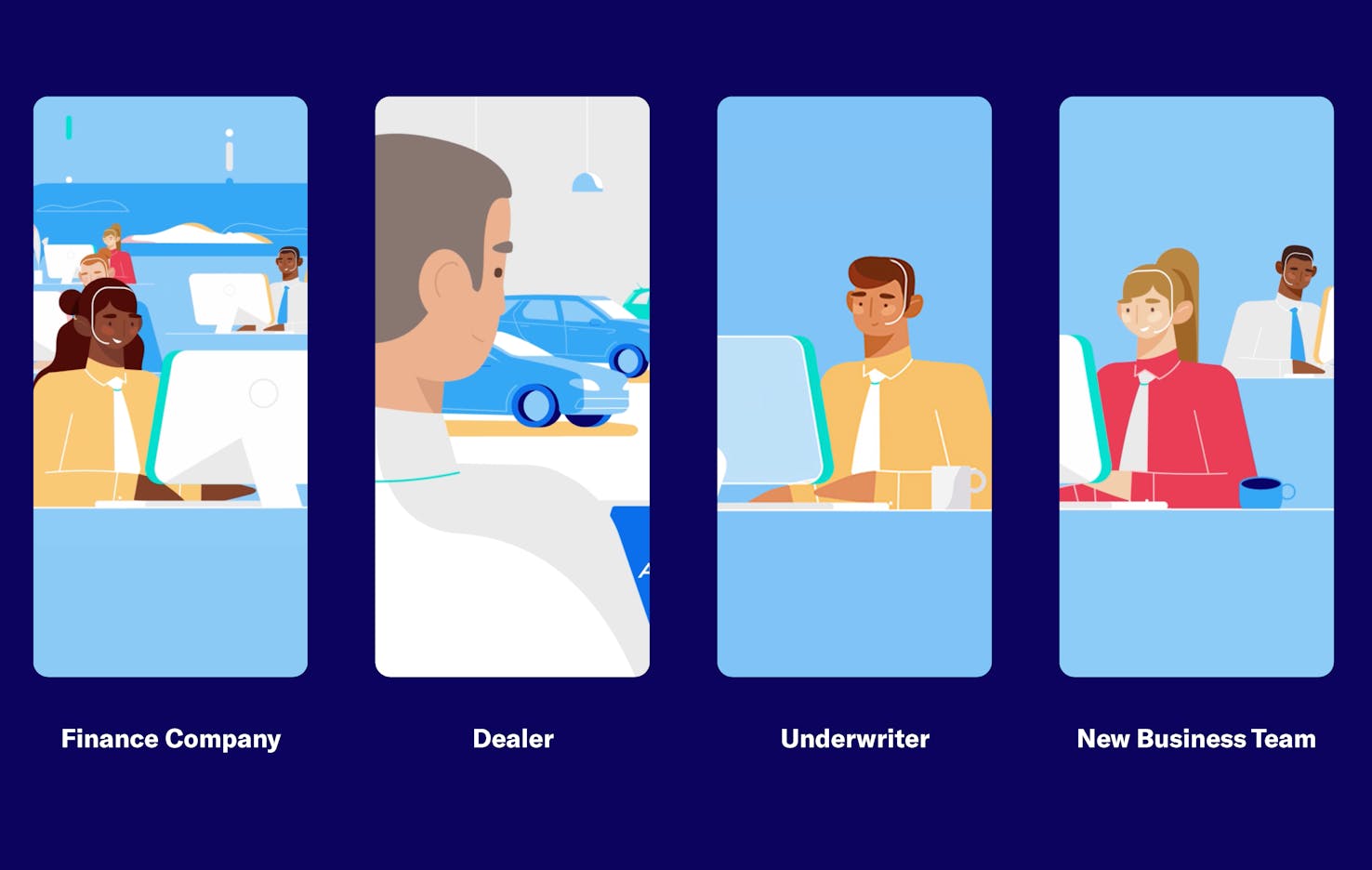

Originations in action

Total capability, across the entire originations journey and beyond.

Alfa’s best-in-class originations functionality is already established with a string of notable brands with international footprints. They harness its robust suite of tools, which includes campaign management, complex quoting, underwriting and credit conditions, credit snapshots, line-of-credit approvals and a powerful credit decision engine; all exposed by a suite of flexible APIs.

Today, we're witnessing a dynamic shift in the market landscape. In addition to a growing trend in direct lending (see below), compelling developments include the emergence of new asset types, not all of which rely on franchised dealers. There's greater accessibility to customer data, with the increasing acceptance of modern data sources like Open Banking, facilitating the safe expansion of originations volumes.

The adoption of innovative technologies is empowering automation, ushering in a new era of efficiency. Users can benefit from easy, invisible integrations with custom service providers, such as intelligent document reading. The use of no-code integration layers, as well as workflow and rules that incorporate business logic, can streamline processes further. Document metadata or KYC data can be compared with data from credit snapshots, with business rules triggering automated workflows or a feed into credit decision engines and scorecards, resulting in rapid, automated responses for a large proportion of decisions. This heightened level of automation releases valuable resources, leaving users time to deal with more complex, higher-margin transactions.

Exploiting new direct lending channels

In the US, the trend of increased direct sales, and therefore lending, gains momentum with the growth in EVs and the desire to own the customer relationship. Tesla has been at the forefront, paving the way for direct-to-consumer sales, a model adopted by EV companies like Polestar and Lucid, who operate without franchised dealers. This movement has prompted some established brands to create new, EV-focused entities, and while the extent of permitted direct sales varies from state to state, a pure online sales journey remains an option - albeit with some inconvenience.

The direct-sales model is changing the game for both OEMs and dealers. The shift to direct-to-consumer sales allows OEMs to realise higher price points since dealerships must adhere to the MSRP and can no longer undercut one another.

In Europe and the UK, where legislation doesn't present a barrier to direct sales, there is a notable shift towards this model.

Today two thirds of consumers and more than 80% of younger car buyers are open to the concept of digital retailing. Whether it's checking availability, sourcing a valuation, booking a test drive, paying a deposit, or organising finance, 60% of car buyers would like to do these key jobs online.

The Alfa Systems Originations solution

Upholding our commitment to enabling excellence in both direct and indirect lending, Alfa continues to set the standard in the industry.

Originations in Alfa Systems offers choice and versatility, allowing you to design your own direct lending capabilities using the full suite of APIs, combined with workflow- and AI-powered, fully automated underwriting. Alternatively, you can handle quote requests from dealers through pre-built interfaces and leverage the multiple user journeys provided out of the box. Optional add-ons allow for more complex solutions through a wider range of functionality.

Meanwhile, larger OEMs benefit from superior functionality for dynamic, dealer-specific campaigns updated seamlessly via APIs with no downtime. With price-setting moving increasingly from the dealers to the OEM, the reactive ability for volume brands to adjust prices quickly, in order to meet targets, is increasingly important.

In an increasingly digitised world, customer buying habits have changed, and an agency model provides a consistent and transparent purchase journey, whether that’s online, in a physical showroom, or a combination of the two.

For the niche asset financing company, Alfa Systems' decisioning engine provides automated credit decisions and scorecards, without the need for integrations.

Get started with Alfa Systems: