Insights

LIBOR Reform: The Impact for Auto and Equipment Finance Providers

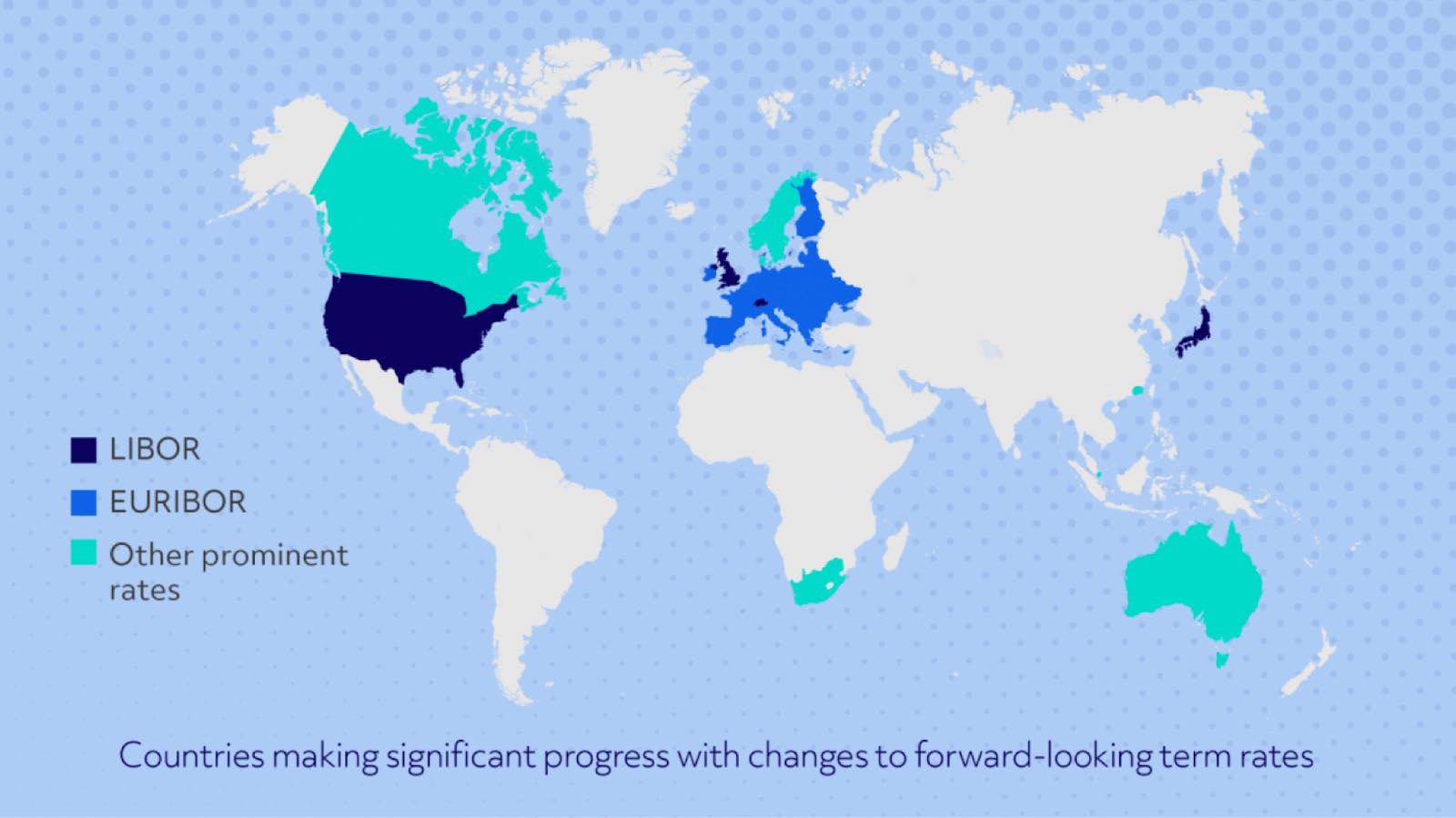

LIBOR rates are used by auto and equipment finance businesses globally as a benchmark to determine customer interest rates. However, LIBOR, EURIBOR and other such rates carry inherent shortcomings which have led to their forthcoming replacement by alternative risk-free rates such as SONIA and SOFR.

In our whitepaper, we discuss why this is happening, what it means for finance providers who need to make the transition, and how their systems must be enhanced to accommodate the changes.

What are the alternatives to full adoption of risk-free rates?

- Switch from term rates to base rates. The financial characteristics of a base rate are quite different to those of a term rate derived from a money market; they might not be appropriate for a provider whose cost of funding tracks money market rates more closely than base rates, or who wishes to hedge interest rate risk across credit and debit products.

- Switch from term rates to fixed rates. Similarly, a point-in-time transition to fixed rates should generally be supported, but the interest rate risk incurred may not be acceptable.

- Model risk-free rates within existing interest rate structure. While it’s possible to achieve a reasonable approximation of a risk-free rate calculation using base rate functionality, there will be calculation differences. Furthermore, screens and processes intended to support a handful of base rate changes a year may not function at their best when each contract experiences hundreds of rate changes.

New risk-free rates

- Sonia - A trimmed average of overnight GBP-denominated deposit transactions.

- SOFR - Based on overnight transactions in the US dollar Treasury repo market.

- €STR (or ESTER or ESTR) - Based on wholesale Euro unsecured overnight borrowing costs of European banks.

Alfa Systems was already capable of addressing many of the system support requirements before the LIBOR transition became a reality. Alfa has been working on a solution that allows a smooth transition to risk-free rates for existing businesses at scale.

Find out more about Alfa Systems and how it can help you with the LIBOR change process.