Systemised decision-making through AI and rules-based workflows.

Founded on six pillars, Alfa Systems 6 helps finance providers tackle the significant challenges they face, and seize the lucrative opportunities that lie waiting.

Why Intelligent Automation?

Intelligent Automation in Alfa Systems 6 harnesses cutting-edge cognitive technologies, including predictive modelling, to empower our customers to create efficiency gains through a variety of intelligent, automated decision-making tools.

Equipping Alfa Systems and its customers with solutions that provide real functionality and real value, Intelligent Automation is designed to:

- Automate any and all of your processes: Alfa customers have the power to automate their processes to an extent that suits their business. Decision trees and nested rulesets, triggered by automated workflows, business rules and APIs, allow a heuristics-driven intelligent experience at common customer touchpoints.

- Onboard and upskill people: AskThea, the conversational AI chatbot for Alfa Systems support and guidance, offers immediate insights for users seeking answers, available functionality and potential solutions.

- Onboard new products and processes: Using AskThea, business change professionals can quickly consult Alfa Systems documentation to understand workflow and other configuration changes needed to implement new processes, providing further flexibility and power.

- Understand and reduce portfolio credit risk: Alfa Decisioning, a brand new credit decision engine, combines with Alfa iQ's proven experience in predictive AI for dynamic optimisation of credit underwriting, with customer-specific modelling.

See Intelligent Automation in action:

Intelligent Automation in Alfa Systems 6

"Asset finance providers are demanding more from their technology suppliers and departments, and full automation of basic processes is now a baseline expectation. By integrating cutting-edge AI and automating complex processes, with Intelligent Automation we are exceeding these expectations. Innovative tools like AskThea and Alfa Decisioning enable our customers to make smarter decisions, achieve exceptional efficiency, and stay ahead in a competitive, evolving market."

Introducing Intelligent Automation in Alfa Systems 6

As the hype over AI reaches its peak, business people are expecting more from their technology suppliers and departments. Full automation of basic, 'green path' processes has become a baseline expectation, with the phrase “manual intervention” verging on profanity.

Expectations are high, not just around the automation of operational processes, but also for efficiency gains within technology implementation projects, as well as healthier financial outcomes - all driven by superior, constantly learning, rules-based intelligence.

On the flip side, considering the obligation to understand and comply with data ownership, data quality, auditability, and ethics and security concerns, most customer-focused AI applications in our industry are slow to come to market. These concerns are genuine, and those forging ahead may not be paying them adequate attention.

Furthermore - and especially for intelligent models that rely on inputs from the financial markets - the adage that “if you want to know the future, look at the past” does not hold true in this context. Systemic changes from Covid, inflation and sudden interest rate hikes suggest that subjective decisions may yield better outcomes than models trained on recent data.

With these dynamics in mind, for Intelligent Automation Alfa has harnessed the experience, skills and modelling insights developed through our established AI service, Alfa iQ, since its first-mover launch in 2020. This allows us to integrate advanced tools that deliver significant benefits to our customers:

- Automated, auditable rules-based workflows provide benefits akin to AI decisions, but allowing our customers a greater element of control and explainability.

- AskThea is a conversational AI chatbot for Alfa Systems support and guidance, providing immediate insights on product support.

- Alfa Decisioning is a rules-based credit decision engine with AI model integration, providing next-generation credit underwriting with customer-specific modelling.

Streamline and scale decision-making across your organisation

Understand credit risk in your portfolio, simplify processes, free up resources and improve operational efficiencies.

1. Enhanced rules-based workflows

From complex pricing rules and conditional underwriting, to actioning of document discrepancies and implementing the 'best action' at termination, Alfa Systems incorporates a range of automated workflows built upon complex decisions. Alfa is constantly enhancing this functionality, allowing new parameters or entities to feed into the decision rules and adding new paradigms to trigger actions.

An example, among many enhancements we've made for Alfa Systems 6, is allowing actual usage (compared to contract estimated usage) to trigger rules-based decisions for an early termination, or extension of contract end date, allowing for complex provision calculations.

Although Alfa is exploring in detail the use of predictive AI within workflows, the results currently achieved through a network of business rules nevertheless represent intelligent automation and are highly effective. A significant advantage of this approach is that the Alfa Systems user can easily learn, from within the user interface, the complete audit trail of the data and decisions that led to the triggering of a particular outcome, thereby enabling a wider spread of feasible use cases for automation.

2. AskThea

Built in-house by Alfa's innovators, and supported by proven generative AI services, AskThea is a conversational AI chatbot trained on Alfa Systems documentation libraries to provide immediate insights.

AskThea allows Alfa Systems users - including admins, integration developers, support, change management and training - to understand the functionality provided in Alfa Systems more efficiently, and offers instant answers on how best to meet new business or technical requirements.

AskThea is highly extensible, allowing for a wide variety of resources to be integrated alongside Alfa libraries. From administrative tasks, such as customer-specific configuration assistance and API guidance, to user assistance in training and customer procedure, AskThea is always evolving and increasingly beneficial.

3. Alfa Decisioning

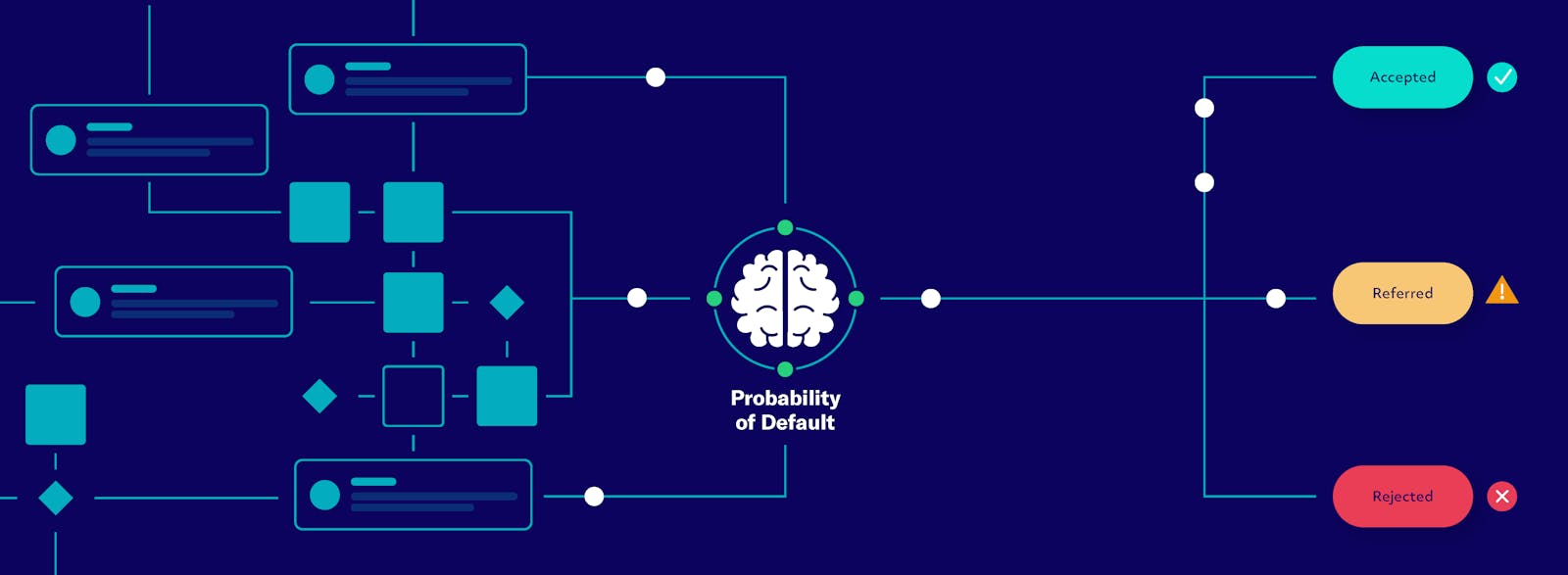

Building on Alfa Systems' exceptional underwriting capabilities, Alfa Decisioning is a next-generation credit decision engine which can be augmented with a 'pluggable' AI model.

Alfa Systems customers can create their own decision trees and scorecards, based on insights from end-to-end customer lifecycle data extracted from Alfa Systems' Operational Data Store. Created through a drag-and-drop visual editor, decision trees are called by Alfa Systems' workflow engine, allowing full automation for an increasing proportion of underwriting decisions.

Building on our experience implementing 'Probability of Default' calculators with Alfa iQ, these decision-based rules can be further augmented by a customised predictive AI model. By integrating customer data with insights from credit reference agencies and the customer's historical behaviour on Alfa Systems, the model generates a probability of default as additional input to the rule engine, thereby reducing risk and potentially expanding into new market sectors.

Intelligent Automation: Future blueprint

Alfa Systems’ Operational Data Store (ODS) houses a wealth of information for use in reporting and analytics. However, the breadth of data available can make reporting tasks daunting for business users.

Forthcoming report generation tooling will enable users to describe the information they need in natural language, allowing rapid access across ODS data structures without an intimate knowledge of the data dictionary - empowering non-technical users to build the reports they need, easily.

Alfa Systems customers have access to a wealth of configuration options that enable them to tailor the platform to their own business needs. By using AI to provide natural language conversation around that configuration, administrators can better understand how modifications may affect Alfa Systems, and subsequently generate documentation tailored to their specific version and configuration set - allowing users greater insight into the operation of various features.

As it becomes easier to generate customer documentation from configuration, it becomes decreasingly necessary to create it. However, customers may have procedural manuals, training materials and other documentation sources from which they’d like to provide a fully integrated natural language help platform. By using Alfa Systems product documentation alongside an interpreted understanding of the customer configuration, as well as customer-provided documentation, Alfa offers a one-stop, self-support solution.

By continuously analysing case progression, operator workload and seasonal effects, Alfa looks to provide cutting-edge predictive analysis. This enables intelligent case assignment, accurate SLA warnings, and deep insights into how workload is handled.

Using a wide range of indicators - including predicted workflow paths, asset information and third-party profiles - Alfa Systems can forecast the duration of each case, identify potential SLA breaches, ensure proper case escalation, and optimise queue management.

For developers, AI tooling is more than simple code generation; it provides a vast array of supporting assistance. It can assist in discussing and critiquing solutions, optimising code for enhanced performance, and understanding existing projects to better integrate new solutions. With intelligent developer assistance, teams can produce more efficient, secure, and tightly integrated code in a fraction of the time.

Looking to our internal processes, at Alfa we use an advanced suite of quality, security and vulnerability scanning tools to ensure a final product that upholds the reliability Alfa Systems is known for. Moving forward, we aim to share these insights with integration developers.

Intelligent Automation: Meeting challenge and opportunity

As competition intensifies, it is crucial for finance companies to produce an initial response as quickly as possible, to as broad a range of requests as possible. With desired automation rates nearing 80%, any increase requires intelligent automation powered by a complex and easily updatable set of rules. AI could play a significant role in advancing and refining these rulesets.

Finance companies must stay ahead of market trends by efficiently adapting business models and piloting new technologies and processes. Keeping their technology up to date, while minimising the costs of upgrades and implementation, is crucial. Generative AI tools like AskThea are ideal for this purpose, as they increase the accessibility of complex product documentation for end users.

Globally, the recruitment and retention of skilled, cost-effective resources have become challenging. It is assumed that great technology with embedded AI can reduce the need for some resources that perform basic functions. More realistically, AI can reallocate workloads by automating low-value, repeatable tasks, freeing up resources for higher-value activities and revenue generation, thereby increasing job satisfaction. Alfa’s automated workflows, along with the piloting of internal GPT and Copilot for technology processes, can help mitigate this issue.

Customers expect more. A new father recently shared how he uses analytics from a baby monitor to understand his baby’s sleep patterns, reflecting a trend of heightened expectations. Customers now demand efficient, accurate, almost real-time responses - something that is not always feasible with human, manual processes. Automated workflows, incorporating business rules and natural language models where possible, enable fast responses while maintaining a high-quality customer experience.

As AI evolves rapidly and reaches further into every business, so do the regulations that govern it, and the expectations of reliability placed upon it. While regulators strive to codify guidelines and rules to ensure the fair and equitable operation of AI, we find the rapid pace of innovation often outstrips this, creating a treacherous gap for businesses to navigate.

Initially, Alfa takes an 'AI as a guiding hand' approach wherever possible, going to great lengths to minimise risk to both individuals and businesses. We work closely with AWS and other partners to monitor legislative changes and ensure they are incorporated in the development process.

Alfa’s key differentiators - excellence in people, technology and delivery - ensure that you can trust us with all aspects of AI, including consultancy around its implementation.

While Alfa has a wealth of experience at our hands in building our own custom AI solutions, we strive not to reinvent the wheel when we can leverage partner relationships to deliver a seamlessly integrated AI experience. From identity verification to document recognition and comprehension, through a rich range of APIs and services Alfa Systems is designed with future customisation and integration in mind.

Find out more in Alfa Systems 6’s final pillar, Collaborative Ecosystem: Simple integration with market innovations and through Alfa’s trusted partner network.

Get started with Alfa Systems: